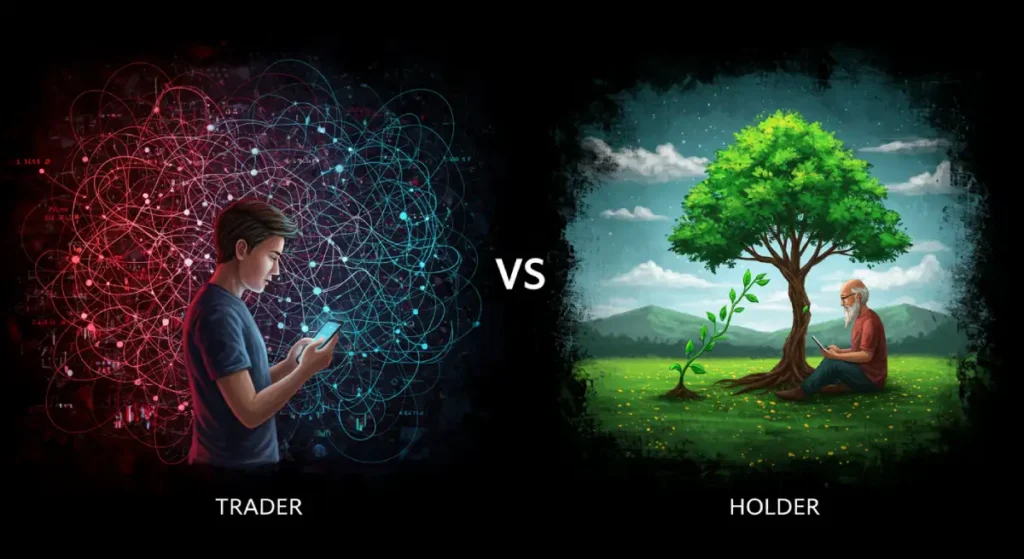

In the dynamic world of investing, two distinct strategies dominate: trading and holding. Traders seek quick profits by capitalizing on short-term market fluctuations, while holders adopt a patient, long-term approach, betting on the steady growth of high-quality assets. Each strategy has unique strengths and weaknesses, with potential returns varying based on market conditions, skills, and risk tolerance. This article explores the pros, cons, and return potential of traders and holders, empowering investors to choose the path that aligns with their goals.

Traders: Chasing Short-Term Gains

What is a Trader?

A trader buys and sells assets—such as stocks, cryptocurrencies, or forex—to profit from short-term price movements. Their investment horizon ranges from minutes (day trading) to days (swing trading), relying heavily on technical analysis and market timing.

Pros of Trading

High Return Potential: In volatile markets, such as the 2021 crypto bull run, skilled traders can achieve exponential gains. For instance, a trader buying Bitcoin at $30,000 and selling at $60,000 could double their investment in weeks.

Flexibility: Traders adapt quickly to market shifts, profiting in both bull and bear markets through strategies like short-selling.

Learning Opportunities: Frequent trading hones skills in technical analysis, risk management, and market psychology.

Cons of Trading

High Risk: Short-term price swings are unpredictable, and sudden events (e.g., regulatory changes) can lead to significant losses. Studies show 70%-90% of day traders lose money over time.

High Costs: Frequent trades incur transaction fees, spreads, and taxes, eroding profits. For example, a 0.1% fee on a crypto exchange accumulates rapidly with high-frequency trading.

Time-Intensive: Trading demands constant market monitoring and analysis, creating stress and conflicting with other responsibilities.

Emotional Pitfalls: Volatility can trigger impulsive decisions, such as panic-selling or chasing hyped assets (FOMO).

Potential Returns for Traders

Short-Term: In bullish or volatile markets, skilled traders may achieve 50%-100% annual returns or more, but losses are equally likely.

Long-Term: Most retail traders struggle to outperform the market’s average (e.g., S&P 500’s 7%-10% annual return) due to costs and errors.

Holders: Building Wealth with Patience

What is a Holder?

A holder employs a buy-and-hold strategy, investing in high-quality assets like index funds, blue-chip stocks, or Bitcoinfor years or decades. They prioritize fundamental analysis and trust in the long-term growth of their investments.

Pros of Holding

Lower Risk: Quality assets weather short-term volatility. The S&P 500, for instance, has delivered 7%-10% annualized returns over a century, recovering from crashes.

Low Costs: Infrequent trading minimizes fees and taxes. Holding an ETF like VOO for 20 years incurs negligible costs compared to active trading.

Compounding Power: Long-term holding with reinvested dividends or gains drives exponential growth. For example, a $10,000 investment in the S&P 500 in 1980 could grow to over $200,000 by 2025.

Time Efficiency: Holding requires minimal monitoring, ideal for busy investors with limited time.

Simplicity: No need for advanced technical skills; select strong assets and wait.

Cons of Holding

Long Wait for Returns: Significant gains may take years, lacking the thrill of quick profits.

Asset Selection Risk: Choosing underperforming assets (e.g., declining industries) can lead to low returns or losses.

Market Volatility: Short-term dips, like the 2022 crypto bear market, can test patience.

Opportunity Cost: Holders may miss short-term trading opportunities in volatile markets.

Potential Returns for Holders

Short-Term: Returns vary with market conditions, potentially negative in bear markets or modest in flat markets.

Long-Term: Historical data favors holding. For example, Bitcoin grew from $1,000 in 2017 to $50,000 by 2025 (50x return), while stock market holdings typically yield 7%-15% annually.

Trader vs. Holder: A Side-by-Side Comparison

Aspect | Trader | Holder |

|---|---|---|

Goal | Short-term profits | Long-term wealth |

Timeframe | Minutes to days | Years to decades |

Risk | High | Lower |

Costs | High (fees, taxes) | Low (minimal trading) |

Skills | Technical analysis, quick decisions | Fundamental analysis, patience |

Time Commitment | High (monitoring, analysis) | Low (periodic checks) |

Best For | Risk-tolerant, time-rich investors | Steady, time-constrained investors |

Potential Returns: A Deeper Look

Traders

Best Case: In a bull market, skilled traders can turn $10,000 into $100,000 within a year through high-frequency or leveraged trades (e.g., 2021 crypto surge).

Worst Case: Market crashes or poor decisions can wipe out capital, especially with leverage. Many traders lost heavily in the 2022 crypto bear market.

Key Factors: Success hinges on technical expertise, discipline, and market conditions. Only a small fraction of traders consistently outperform.

Holders

Best Case: Selecting top assets yields massive gains. For instance, a $1,000 investment in Apple in 2000 grew over 100x by 2025.

Worst Case: Poor asset choices or prolonged bear markets may result in low returns, though diversification (e.g., index funds) mitigates this.

Key Factors: Success depends on asset quality, patience, and the market’s long-term upward trend.

Which Strategy Suits You?

Choose Trading if you have time, risk tolerance, and a knack for market analysis. Start with small capital (5%-20% of your portfolio), use strict stop-losses, and limit risk per trade to 1%-2%.

Choose Holding if you seek steady growth with minimal effort. Invest in diversified assets (e.g., 70% index funds, 20% stocks, 10% Bitcoin), use dollar-cost averaging, and review annually.

Hybrid Approach: Allocate 80% to holding for stability and 20% to trading for learning and potential high returns.

Conclusion

Traders and holders represent two sides of the investment coin. Traders surf market waves, chasing high rewards but facing steep risks and costs. Holders plant seeds, reaping steady returns through patience and compounding. Historical data favors holding for most investors, offering reliable 7%-15% annual returns with lower stress. However, skilled traders can achieve outsized gains in the right conditions.

Success in either strategy requires clear goals, risk management, and continuous learning. Traders must master technical analysis and discipline, while holders need to select quality assets and stay the course. Whether you trade, hold, or blend both, investing is a marathon—choose the path that matches your lifestyle and aspirations.

Having read this I thought it was very informative. I appreciate you taking the time and effort to put this article together. I once again find myself spending way to much time both reading and commenting. But so what, it was still worth it!

Thank you. I have give up this website.I will rebuild a new site in the future.I’m busy every day cause I don’t have enough time to operate this site.